form cbt-200-t instructions 2023|new jersey corporate estimated tax : iloilo CBT-150 (Instructions) Statement of Estimated Tax for Corporations : . webBrisa da Praia Hotel, Porto Seguro: Veja 2.406 avaliações, 1.545 fotos e ótimas promoções para Brisa da Praia Hotel, classificado como nº 6 de 168 hotéis em Porto Seguro e com pontuação 4,5 de 5 no Tripadvisor.

0 · nj form cbt 200 tc

1 · nj cbt 200 t instructions

2 · nj cbt 200 t 2023

3 · nj cbt 100 instructions 2023

4 · new jersey corporate estimated tax

5 · form cbt 200 tc

6 · cbt 200 t instructions 2023

7 · More

8 · 2023 cbt 200 t

Resultado da 13 de dez. de 2023 · WynnBET Casino Review 2024. Unbiased review of WynnBET Online Casino. Learn about its collection of 200+ slots, $1,000 .

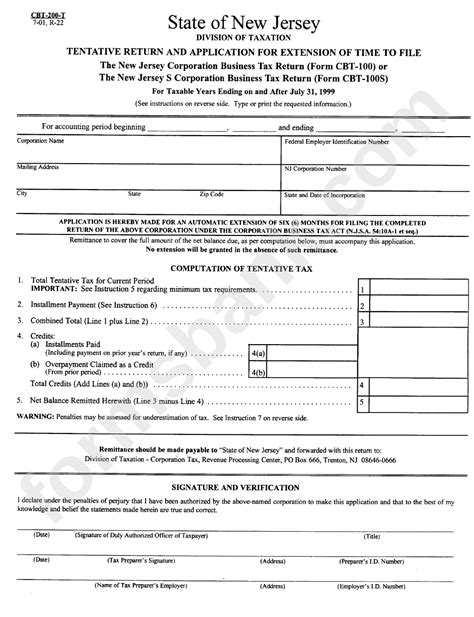

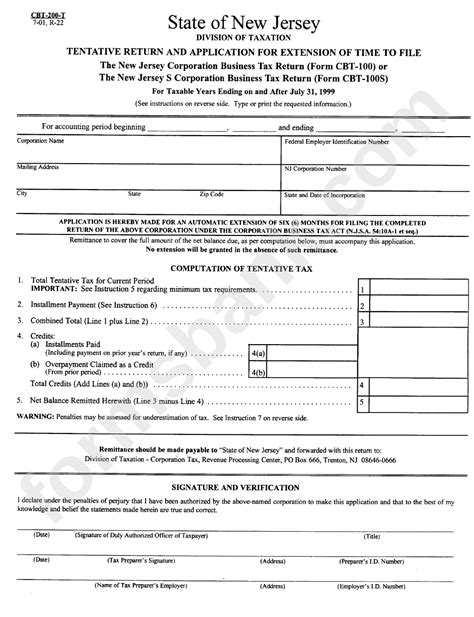

form cbt-200-t instructions 2023*******CBT-150 (Instructions) Statement of Estimated Tax for Corporations : .Cbt100S 2020 Instructions. Cbt100 2021 Instructions. Cbt100S 2021 Instructions. Cbt100 2022 Instructions. Cbt100S 2022 Instructions. Cbt100 2023 Instructions. .Schedule A-7 and Schedule L have also been discontinued. For privilege periods ending on and after July 31, 2023, banking corporations and financial business corporations that .Instructions; NEW JERSEY CORPORATION BUSINESS TAX RETURN . FOR TAXABLE YEARS ENDING ON OR AFTER July 2023 THROUGH June 2024. New .

Download or print the 2023 New Jersey Form CBT-200-T (Corporation Business Tax Tentative Return and Application) for FREE from the New Jersey Division of Revenue. .

The form has been pre-filled with your company's identifying information -- name, address and FEIN, as well the reporting period and return due date. If any of the identifying data .You can use the PIN on the REG-C form supplied with your NJ-927 Quarterly Employer Report or on the PIN coupon inside your ST-50/51 Sales and Use Tax coupon booklet, if .Request an extension for filing your corporation business tax return in New Jersey online. Print your confirmation and keep it for your records.

Insufficiency Penalty:- If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100, or in the case of a .If you file Form PART-200-T, you must also file Form PART-100 “Partnership Return Voucher” when you file Form NJ-1065. Line 1. Filing Fee. Enter the amount from Line 4 of the Filing Fee Schedule located on the back of Form PART-200-T. Do not enter more than $250,000. If you have less than three owners or if you do not have income or loss .form cbt-200-t instructions 2023New Jersey Corporation Business Tax Return, Form CBT-100 or the Corporation Business Tax Unitary Return, Form CBT-100U. Professional Corporations. Corporations formed under N.J.S.A. 14A:17-1 et seq. or any similar laws of a possession or territory of the U.S., a state, or political subdivision thereof, must complete Schedule PC.

If line 1 is greater than $100,000, the tax rate is 9% (.09). If line 1 is greater than $50,000 and less than or equal to $100,000, the tax rate is 7.5% (.075). Tax periods of less than 12 months qualify for the 7.5% rate if the prorated tax .

2023General Instructions. Purpose of Form PART-200-T. Use PART-200-T to apply for a five-month extension of time to file an NJ-1065 that has a filing fee due. Qualifying for the Extension. To be eligible for an extension, you must have paid by the original due date of your return, either through an installment pay- ment or a payment made with .2023 – CBT-100 – Page 2 AME A SHOWN ON RETR FEDERAL D MBER Annual General Questionnaire (See Instructions) Part I All taxpayers must answer the following questions. Riders must be provided where necessary. 1. Type of business Principal products handled 2. State the location of the actual seat of management or control of the corporation 3.Insufficiency Penalty:- If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100, or in the case of a taxpayer whose preceding return covered a full 12-month period, is less than the amount of the tax computed at the rates applicable to the current accounting year but on the .If you answered no to all the above questions, proceed to Part 2 to complete the filing fee schedule. Part 2 – Filing Fee Calculation. 1. Number of Resident Partners x $150. 2. Number of Nonresident Partners With x $150 Physical Nexus to New Jersey. 3. Line 11. Net Privilege Tax Due – Subtract the amount on line 10 from the amount on line 9. Line 12. Penalty Due – Enter the total amount of the penalty for failure to timely file the return and the penalty for failure to timely pay the tax shown due on the return, as specified in Section 40-2A-11, Code of Alabama 1975.

These corporations must complete Form CBT-100S (or Form CBT-100U if they elected to be part of a combined group). Federal S corporations that have not elected and been au-thorized to be New Jersey S corporations must complete this return as though no election had been made under I.R.C. § 1362. A copy of Form 1120-S as filed must be submitted. Due Date Change for Privilege Periods Ending on and after July 31, 2020. The Corporation Business Tax Act imposes a franchise tax on a domestic corporation for the privilege of existing as a corporation under New Jersey law. In addition, a foreign corporation is also taxed for the privilege of having or exercising its corporate charter or .

CBT-206 2023 For period beginning. Make checks payable to “State of New Jersey – CBT.”. Write federal ID number and tax year on the check. , 2023 and ending. Return this voucher with payment to: Extension of Time to File NJ-CBT-1065 PO Box 642 Trenton, NJ 08646-0642. Enter amount of payment here: , 20. $.form cbt-200-t instructions 2023 new jersey corporate estimated tax96 PDFS. New Jersey has a state income tax that ranges between 1.4% and 10.75% , which is administered by the New Jersey Division of Revenue. TaxFormFinder provides printable PDF copies of 96 current New Jersey income tax forms. The current tax year is 2023, and most states will release updated tax forms between January and April of 2024.

web14 de mar. de 2022 · Christiane Torloni, Humberto Martins e Bruno Gagliasso em Caminho das Índias, 2009 — Foto: Frederico Rozario/Globo. RAMIRO (Humberto Martins) –Filho de Cadore (Elias Gleizer), marido de Melissa (Christiane Torloni) e pai de Tarso (Bruno Gagliasso) e Inês (Maria Maya). Homem confiante e manipulador, que certamente gosta .

form cbt-200-t instructions 2023|new jersey corporate estimated tax